IMF sees property taxes as best way to reduce inequality

- Thmey Thmey

- September 7, 2019 4:54 AM

Economists model three options for government to finance increased infrastructure investment to help raise incomes, especially in rural areas

PHNOM PENH --Increased infrastructure investment financed by higher property taxes is the best option for reducing inequality in Cambodia, according to a new study by the International Monetary Fund (IMF).

Released in Washington Friday, the working paper on advancing inclusive growth in Cambodia noted the country’s “solid” economic expansion.

Over the past two decades, growth in real GDP per capita averaged six percent — well above the ASEAN average of four percent. This raised GDP per capita to 11 percent of the ASEAN average in 2017, up from 6 percent in 2001.

Income inequality and infrastructure gaps

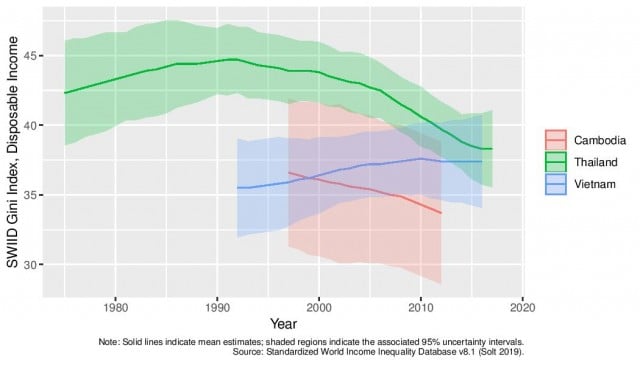

Moreover, inequality has declined with the Gini coefficient for consumption falling from 40.4 percent in 1997 to 29 percent in 2012 .

Income inequalities have been falling in Cambodia but are not as great as Vietnam or Thailand

"This level is well below the ASEAN average. Government policies such as increased spending on education and social transfers could … have played some role."

The study found, however, that "obstacles to growth persist and income inequality between regions remains a concern."

Such disparities are “considerable” with average household incomes in rural areas only 60 percent of those in urban areas.

"At the same time, infrastructure gaps are “substantial” with only 10.5 percent of roads paved — which is low compared with regional peers.

"The share of the population with access to safe drinking water, basic sanitation services, and electricity also remains relatively low.”

According to the study, “enhanced infrastructure could help raise income, especially in rural areas, by improving market access and factor mobility.

"Financing these investments through progressive income taxation, such as property taxation, can help reduce inequality further."

Three options to finance infrastructure

The authors modeled three ways for the government to finance a permanent increase of 0.5 percent of GDP in infrastructure investment — higher property taxes, higher value-added taxes (VAT) and higher income taxes.

Modeling showed that financing through VAT delivered the largest increase in GDP and that higher income taxes yielded the biggest reduction in inequality.

But higher property taxation "generates both the largest positive effect on GDP and the largest reduction in inequality,” the authors found.

Gains from property taxes

"This is because property taxes are inherently progressive — wealthier households own more … valuable property and will thus also pay a higher property tax.

"At the same time, property taxes do not distort the incentive to supply labor or undertake investments.

"Reaping the gains from property taxation will however require additional investments in tax administration.”

The authors added that inequality in Cambodia could be further reduced by targeting infrastructure spending on rural households or by complementing it with more efficient social spending.