Rise of Digital Banking in Cambodia

- By Ou Sokmean

- May 4, 2022 2:20 PM

Shared finance system boosts efficiency

PHNOM PENH – Cambodia’s financial system has undergone a rapid shift to digital banking in recent years. The change has brought another level of efficiency and convenience to customers.

Doung Soklim – a farm contractor in Tboung Khmum province – has her personal bank account with the AMK Microfinance. She lives comfortably as she is able to meet her daily necessities and save money sent by her children who are working in Sihanoukville and Phnom Penh into her account.

Digital banking has saved her great deal of time, in contrast to the past.

“It is super easy nowadays,” she said. “I do not have to go through multiple steps like before such as bringing my phone with me to the transfer agents or bother noting or remembering the passcode.

“Now, I can easily check the amount of money sent by my children on my phone once I receive a call from them.”

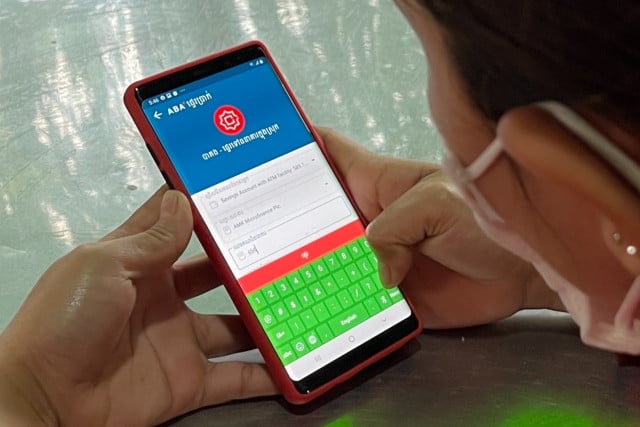

Despite knowing little about technology, the 49-year-old is accustomed to the mobile banking application. She can check her balance and explore other features within the app with the help of her children and AMK Microfinance.

Nevertheless, she rarely made any withdrawal because she would like to save all the money for her children or use it in emergencies.

“Nowadays, my husband and I can rely on our income to sustain our daily living. Therefore, I would save the money sent from my children only for critical cases,” she said.

She is comfortable with her daily routine and can save about $150 monthly she gets from her two daughters. One of them works at a restaurant in Phnom Penh while the other works in a Sihanoukville casino.

Nowadays, financial institutions are constantly updating their mobile apps in terms of daily transactions or QR code features to guarantee the best experiences for users. Besides operating inside a singular system, financial institutions are working cooperatively with one another across platforms.

In Channy, president of the Association of Banks of Cambodia and CEO of ACLEDA Bank, said Cambodia is rapidly embracing digital banking for daily transactions as seen especially in the last two years.

“Banking digitalization is skyrocketing significantly,” Chhany said.

“Contrary to the past, bank counters are responsible for only 10% of the operations whereas before they handled much more. Today, 90% of banking procedures are conducted on mobile apps.”

Bakong: the nation’s financial intermediary

Launched on October 2020, Bakong is a financial intermediary that links banks, micro-finances and financial institutions across Cambodia. Most importantly, it introduces an easy all-in-one interface that aims to maximize convenience and efficiency for users.

Chea Serey, technical director-general of the National Bank of Cambodia, said Bakong was also created to provide additional features or infrastructure to banks or financial institutions which are incapable of developing their own mobile payment software. Now, the institutions can incorporate Bakong into their systems without investing in extra setups.

Sem Kanha, Doung Soklim’s daughter, has been using Bakong for nearly a year and seems satisfied with the service. She uses the Bakong interface to transfer a portion of her monthly salary from her ABA bank account to her mother’s AMK account.

Before Bakong, Kanha had to wait for her restaurant to become less busy before she could travel to the transfer station and send the money home. She says transferring via Bakong is like transferring within the ABA bank network. The service is quick and cheap.

Chea Serey said Bakong also aims to provide comfort in terms of cross-border transactions to improve the lives of local people and especially migrants living or working outside Cambodia.

The 2021 National Bank of Cambodia annual report says Bakong has 55 banks and microfinances registered in the system with approximately 250,000 users nationwide. And 27 out of the 55 financial institutions have incorporated Bakong while the remaining institutions are still observing and reconciling it.

In the context of Covid-19, Bakong uses a peer-to-peer (P2P) network which handles every transaction virtually without physical contact. Users have the freedom to settle purchases online through options including depositing, withdrawing and other e-wallet features.

Bakong has successfully hosted 5.7 million transactions with 1.2 million cases in riels and 4.5 million in dollars. In total, Bakong had approximately circulated 2.3 billion worth of US dollars (a combined transaction of 1.7 trillion riels and 1.9 billion dollars) across the interface in the previous year.

Channy thanked the Bakong system for contributing to the growth of financial digitalization in Cambodia, saying, “Bakong is a medium that links and registers all banks under the same umbrella, and transactions can be easier settled through the system or QR code technology.”

Kea Borann, CEO of AMK Microfinance, said the Bakong system has helped customers significantly by allowing the institution to perform cross-bank transactions free of charge.

Through Bakong, receiving or transferring money from and to other banks outside the AMK microfinance has been made easier.

“If our customers have business partners or relatives whose bank accounts are not from AMK, customers can still continue with their usual routine via the Bakong system. Therefore, it increases the convenience for our customers,” Borann said.

Based on the acceleration and popularity of the Bakong system, Serey expressed her pride and contentment with the nation’s success. Cambodia is among the first countries to authorize this technology in the banking sector with the aim of enabling smoother transactions and ultimately encourage digital banking in the future.

Promoting mobile banking and digital literacy

Internet availability and digital illiteracy are major issues for Cambodians, especially in rural areas. To solve this problem, the National Bank of Cambodia is working to broaden the knowledge of the public in ways including programs implementation and financial education.

These policies have support and get encouragement from policymakers including the chairman of the Cambodia Microfinance Association, Sok Voeun.

Voeun said that when people, bank institutions and authorities participate, loopholes or errors that often occur in digital platforms will be addressed professionally. The age of digitalization will be easier to understand since most of us each have smartphones, especially young people.

With high technological exposure, people will catch on quickly and soon realize the benefits of e-banking interfaces such as Bakong.

Simultaneously, it lets the banking sectors upgrade its capability to match the industrial pace. Voeun said also that people should think about cyber-security to avoid hacking or cyber-threats.

Ratchada Anatavrasilpa, a World Bank senior financial sector specialist, pointed to the importance of digital financial literacy in the modern age to avoid scamming, hacking or being trapped with high-risk debts.

“In the future, the payment system should be developed as a single nationwide system to guarantee greater cooperation and benefits for stakeholders,” said Anatavrasilpa.

Implementation of society policy and digital economy framework

For the last two years, Bakong has been a successful initiative that aligns well with the Cambodia Digital Economy and Society Policy Framework 2021-2035. The framework was designed by the national economic council and launched by Prime Minister Hun Sen in May 2021.

He believes that this framework will revolutionize the economy of Cambodia. Serey said NBC aspired to help the government achieve this vision of building a digitized economy.

Borann of AMK agreed that Bakong has the potential to do so while easing burdens on the government. The government can focus on financial reforms such as encouraging self-banking, focusing on payment of people-to-government (P2G) or government-to-people (G2P), and payment between the government and businesses (B2G/G2B).

These payment initiatives would enhance relations between stakeholders, namely the people, government, enterprises and the vulnerable or poor who are distant from the government.

The Cambodia Digital Economy and Society Policy Framework 2021-2035 sets out to build a vibrant digital economy, accelerate new economic growth, and promote social well-being for stakeholders.

Developing innovative financial instruments and upgrading digital payment systems are essential contributions to the growth of digitalization in Cambodia. This will influence financial and non-financial sectors resulting in interoperability, comprehensiveness, security, effectiveness and trust.

In addition, the National Bank of Cambodia has put forth in-depth policies to encourage the use of e-banking in a risk-free manner. Most importantly, NBC will focus on designing better policies to raise awareness of e-banking.

In the future, NBC aims to extend partnerships within the region to simplify cross-border transactions to ultimately reduce transaction costs and promote the use of QR codes in Cambodia.

The World Bank’s Anatavrasilpa said digitalization is extremely important in the financial sector and will bring greater benefits to the participants, especially in the context of Covid-19.

This story has been produced as part of a report competition run by bank and microfinance institutions

Song Daphea contributed to this story