Why Europe is Hungry for Chips

- By Agence France-Presse (AFP)

- August 9, 2023 8:50 AM

Paris, France -- Taiwanese chipmaker TSMC agreed Tuesday on a multibillion-dollar deal to build a plant in Germany, part of a push to put Europe at the centre of the global semiconductor industry.

The United States and China are embroiled in a fierce rivalry to dominate the chip industry, and Europe is investing billions to keep up.

- Why the rush for chips?

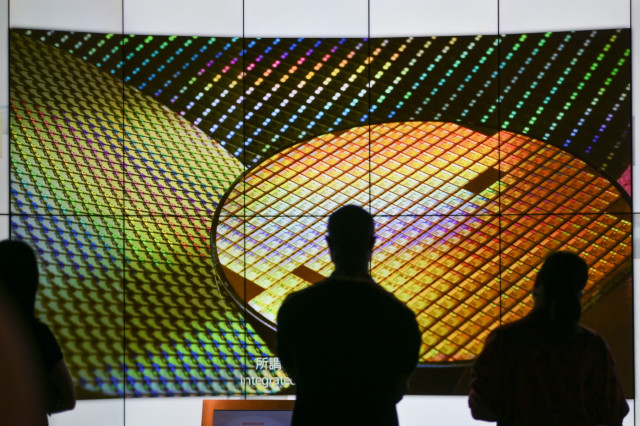

Semiconductors are the tiny components found in every electronic device, from children's toys and smartphones to electric cars and sophisticated weapons.

The Covid pandemic and subsequent border shutdowns caused a shortage of chips and brought large parts of the tech industry to a standstill in 2020 and 2021.

The crisis jolted governments into action, with the United States and China taking increasingly stiff measures to secure supply chains.

- What is Europe doing?

Europe is proposing a law to bolster investment in the industry.

The so-called Chips Act, which is winding its way through the EU's legislative processes, aims to unlock 43 billion euros ($49 billion) in investment from public and private entities.

The goal is for the EU to capture 20 percent of global chipmaking by 2030, which would involve quadrupling its current output.

- Who is investing?

So far in Europe, Germany is way ahead.

The investment from TSMC came two months after Berlin brokered a deal with Intel to build a 32-billion-euro plant.

Germany also closed massive deals with the US firm Wolfspeed and the homegrown company Infineon earlier this year.

The Intel deal, though, sparked some controversy.

Estimated costs for the Intel plant almost doubled, and sources told AFP the government had promised 9.9 billion euros of public money in subsidies.

France also announced in June that it would invest 2.9 billion euros in a plant run by European multinational STMicroelectronics and the US company GlobalFoundries.

- Is Europe taking sides?

The US has introduced a raft of measures aiming to halt cooperation between US and Chinese firms, and Beijing has hit back with export controls on key materials.

While the EU has called on both sides to relax measures that are ensnaring European companies, the bloc is yet to come up with an organised response.

Instead, individual countries have taken the initiative.

The Netherlands, which has a key position in the sector thanks to equipment maker ASML, said in February it would introduce export controls in September.

The move was widely seen as a way of blocking China, with the Netherlands under pressure from the US.

And Germany blocked the sale of two chip firms to China last year, citing national security concerns.

- Who are the leaders?

From design to manufacture and end-use, the semiconductor industry is truly globalised.

Almost all of the raw materials needed to make the chips -- silicon, germanium and gallium -- are produced in China.

Taiwan, home to the world's leading chip manufacturers, accounts for more than half the global output.

Top chip designers like NVIDIA, along with equipment makers like Apple, are US-based.

The Semiconductor Industry Association, a US-based trade body, said US firms accounted for 48 percent of the global industry last year.

South Korea, where Samsung is a world leader, was second with 14 percent, and Europe was in third place with nine percent of the market.

© Agence France-Presse