Potential Microfinance In-Depth Investigation Put on Hold

- By Phoung Vantha

- July 3, 2023 5:13 PM

PHNOM PENH – A planned investigation into whether projects linked to the International Finance Corporation (IFC), a World Bank-affiliated organization, have contributed to predatory lending in Cambodia has been called into question.

On June 13, the IFC watchdog, the Compliance Advisor Ombudsman (CAO), said an investigation was needed to determine whether the lending practices of six Cambodia-based microfinance institutions (MFIs) and banks contributed to the suffering of Cambodian borrowers.

These banks – ACLEDA, Amret, Prasac, Hattha Bank, LOLC and Sathapana – are linked to 18 active IFC projects supporting lending programs for micro, small and medium enterprises.

Four financial intermediaries – Microfinance Enhancement Facility (MEF), Microfinance Initiative for Asia Debt Fund (MIFA), Advans S.A. and North Haven Thai Private Equity Fund L.P. – were also to be scrutinized by the CAO.

However, the investigation could be delayed or canceled after IFC’s management submitted a request on June 29 for a board review of the CAO’s decision to investigate.

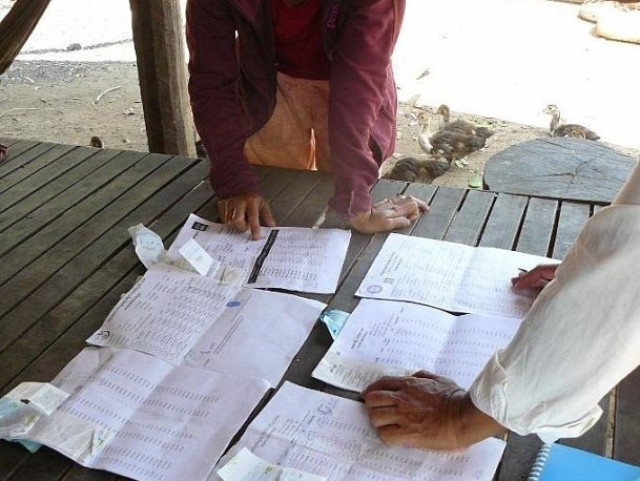

The investigation process started in January 2022 when two Cambodia-based NGOs, the Cambodian League for the Promotion and Defense of Human Rights (Licadho) and Equitable Cambodia, filed a complaint with the CAO to highlight the potential bad lending practices of several local banks and MFIs linked to the IFC.

While CAO’s assessment came to the conclusion that a more in-depth examination was required, the IFC’s appeal could lead to the cancellation of the investigation.

“The IFC management’s request for board review, after the CAO decided an investigation is merited, is a shameful ploy to avoid scrutiny,” said Licadho’s Outreach Director Naly Pilorge in a statement published on July 3. “The IFC needs to prove that it is committed to accountability through the CAO and stop trying to corrupt an independent process.”

“An investigation is a crucial step toward justice and remediation for Cambodian borrowers who continue to suffer due to predatory lending,” she added.

A $10 billion industry

Cambodia is one of the countries with the most developed microfinance sector. According to the National Bank of Cambodia’s 2022 Annual Supervision Report, the total assets in the MFI industry accounted for $10.8 billion as of Dec. 31, 2022.

While microloans can help develop businesses thanks to offering investment capacities to borrowers, bad lending practices from MFIs in Cambodia and excessive collaterals have long been criticized by human rights defenders.

In June 2021, Licadho published a report highlighting the experiences of people from 14 communities in eight provinces who were struggling with overwhelming microloan debt.

“The majority of these microloans are collateralized with borrowers’ land titles, posing a serious risk to borrowers’ land tenure security,” the report said. “Nearly all of the loans carry an 18 percent annual interest rate, the legal maximum, while effective interest rates can be much more than that due to up-front fees.”

The report noted that at the end of 2020, the average microloan in Cambodian stood at $4,280, which was the highest amount in the world at that time, and represented “more than the annual income of 95 percent of Cambodians.”

The NGO cited research that the microfinance sector is highly saturated, resulting in massive competition among lenders which had led to aggressive door-to-door loan solicitation as well as an over-reliance on land as security.

“Loan sizes have increased faster than incomes for the past decade and a half. This irresponsible growth has left people deeply indebted and vulnerable to human rights abuses as borrowers are pushed to undertake desperate actions to repay loans,” the report said, citing coerced land sales, unsafe migration, eating less food or child labor.

“These actions are a direct result of the sector’s rapid growth, which has been fueled by investments from private and public actors, including the World Bank’s International Finance Corporation (IFC) and many state development agencies in Europe and the US,” it added.

The complaint filed by Licadho and Equitable Cambodia, which goes by the name “Cambodia: Financial Intermediaries 04”, aimed at sounding the alarm at the international level and trying to address some of these issues.

But a new policy, instituted in 2021, allows IFC management to request a board review of the CAO’s decision on technical grounds.

It is the first time such a request has been made since the policy was implemented.

The Commission now has 10 working days to examine the IFC's request.

It can either authorize the compliance investigation to continue, reverse the CAO's decision, or give itself additional time to consider the request.